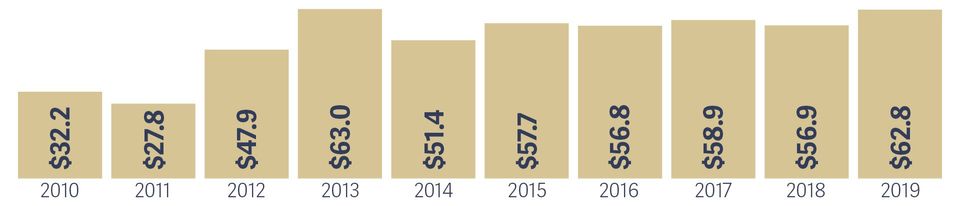

Financials

The Foundation recorded its second-largest fundraising year ever in 2019, with $62.8 million in new gifts and pledges. That includes $15.2 million in new gifts to the endowment. It was the seventh-consecutive year that the Foundation’s fundraising total has exceeded the $50 million mark.

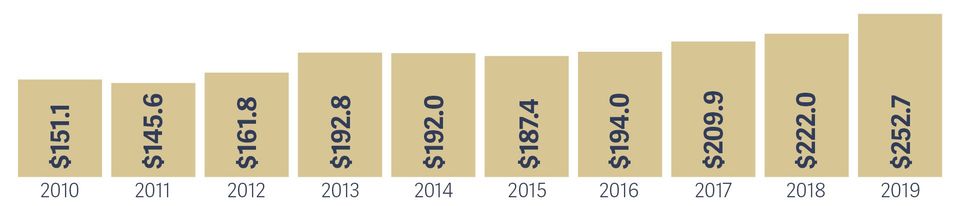

Historic market value of pooled endowment

The Foundation’s pooled endowment was $145.7 million, as of December 31, 2019.

The Foundation manages more than 1,997 individual endowment funds. The funds are pooled together for investments purposes, yet each endowment maintains its own identity and separate accounting. Amounts available for distribution are calculated annually using a spending formula consisting of a percentage (currently 4%) of each fund’s average market value over a period of time (currently 20 quarters).

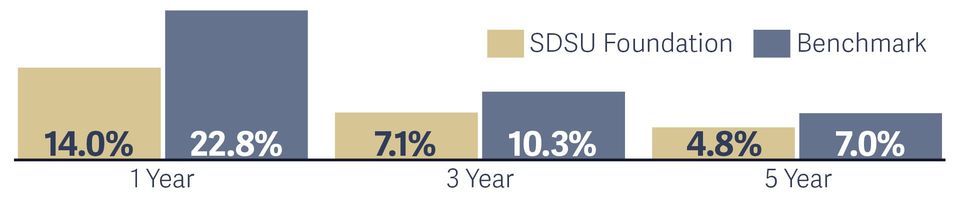

Pooled Endowment Portfolio Investment Returns vs. Benchmark

December 31, 2019

The endowment gained 14.0% over the one-year period ending December 31, 2019. Over the trailing 3 and 5-year periods, the endowment returned 7.1% and 4.8%, respectively, net of investment manager fees. The Foundation maintains a diversified portfolio, with an asset allocation of 17% U.S. Equity, 22% Non-U.S. Equity, 48% Fixed Income, 3% Hedged Strategies, and 10% Private Investments.

Total Support

(provided for scholarships, programs and capital projects)

(in millions)

The $20.7 million in support reflects funding that the university was able to spend from private gifts in 2019.